Ever felt that the medical billing process is a tangle of paperwork, codes, and cryptic replies from insurance companies? You’re not by yourself. The Explanation of Reimbursement, or EOR, is one of the billing cycle’s most misinterpreted papers. At DoctorPapers, we don’t just decode EORs; we help providers take control of their revenue with smart, efficient billing solutions. So let’s break it all down for you in plain English.

The EOR Demystified

An EOR is a document provided by insurance companies that details the processing of a claim in the context of medical billing services. It lists the amount spent, the adjustments made, and, often infuriatingly the things that were rejected. Imagine it as the report card you receive after your medical claims have been examined. Whereas EORs can directly impact your bottom line, unlike report card.

Why You Can’t Ignore EORs

EORs provide the answers to three important questions and are not just used for recordkeeping:

- Did the insurance pay the correct amount?

- If not, why not?

- What can we do about it?

Every provider, clinic, or billing specialist dealing with billing and coding services needs to understand EORs to identify underpayments, fix denied claims, and appeal when necessary. Ignoring them? That’s just leaving money on the table.

What’s Inside an EOR?

Each EOR contains detailed information about:

- Patient and provider details

- Claim number and dates of service

- Billed amount vs allowed amount

- Paid amount and adjustment codes

- Denial reasons (if any)

- Patient responsibility (like copay or deductible)

One confusing part is the adjustment codes. These little combinations of letters and numbers tell you why a certain charge wasn’t paid. But don’t stress, DoctorPapers helps providers decode these like pros and take immediate action.

EOR vs EOB vs ERA – Know the Difference

You’ve probably heard of EOBs (Explanation of Benefits) and ERAs (Electronic Remittance Advice), too. Here’s the deal:

- EOBs are patient-focused and show what part of a claim the patient owes.

- EORs are provider-focused and explain how the insurance adjudicated the claim.

- ERAs are the electronic version of either EOR or EOB, integrated into software systems.

If you’re managing multiple claims every week, ERAs can save hours—but only if you know how to use them right.

Denied Claims: The Hidden Goldmine in EORs

The majority of providers are unaware that rejected claims are not dead claims. They are chances. All you need to do is examine the EOR to determine the cause of the refusal, address the problem, and submit again. The following are some typical explanations for rejections that show up in EORs:

- Incorrect coding (yes, even one digit can wreck a claim)

- Missing documentation

- Non-covered services

- Timely filing violations

At DoctorPapers, we specialize in reworking denied claims by cross-referencing the EOR data, updating coding or documentation, and appealing where necessary.

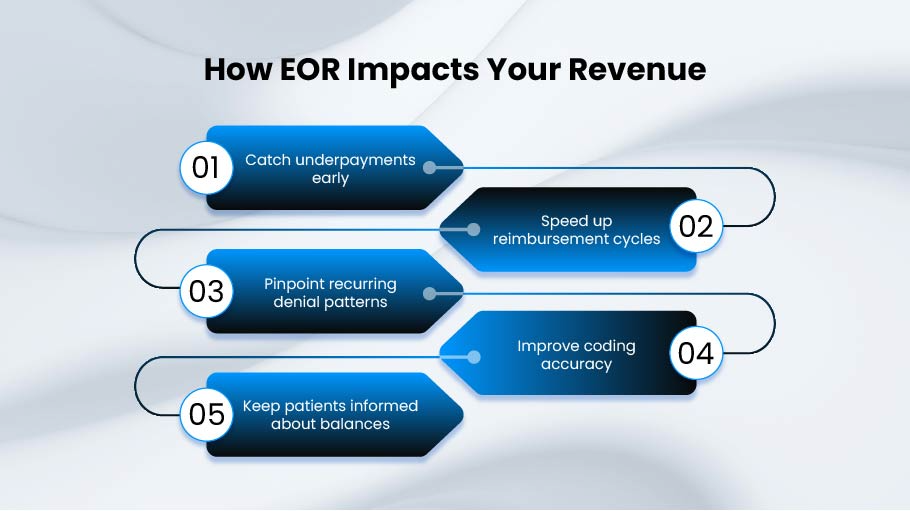

How EOR Impacts Your Revenue

Do you still consider EORs to be “just paperwork”? Rethink your thought. Every month, providers who disregard EORs frequently lose thousands of dollars. EORs increase revenue in the following ways:

- Catch underpayments early

- Speed up reimbursement cycles

- Pinpoint recurring denial patterns

- Improve coding accuracy

- Keep patients informed about balances

Even if you’ve outsourced your billing, you should ensure your billing partner is actively reviewing EORs. If they’re not, it’s time for a serious conversation—or a switch to someone who gets it.

Manual vs Automated EOR Processing

Old-school practices still receive paper EORs in the mail. But modern billing teams use digital EORs through ERA integrations, which are faster and far more efficient. With automation, software can flag denials, match payments to billed charges, and even trigger appeals automatically.

At DoctorPapers, we integrate these tools into your workflow so your team doesn’t miss a thing.

Common Mistakes in EOR Handling

Let’s be honest, most practices don’t give EORs the attention they deserve. Here are a few costly mistakes:

- submitting them without a review

- Not contesting rejected claims

- EORs and reported charges do not match.

- Patterns missing in recurrent denial codes

- Assuming “paid” means “paid correctly”

When you fix these mistakes, your billing becomes smarter—and your cash flow improves.

The DoctorPapers Approach to EORs

EORs are like goldmines of data to us. Every line is examined by our medical billing services staff, which then pulls important information and responds right away. Our staff takes care of everything, including delivering follow-up documents, fixing a CPT code, and appealing a decision. This implies:

- Fewer rejections

- Faster turnaround

- Happier patients

- More revenue in your pocket

And we don’t stop there. We offer detailed reporting so you can see how each EOR contributes to your revenue recovery over time.

Billing and Coding Services That Actually Work

EORs are only part of the puzzle. At DoctorPapers, we bring the full picture together with expert billing and coding services designed to maximize reimbursements from day one. That means:

- Clean claims from the start

- Correct codes for every service

- Fast, accurate submissions

- Immediate action on denied claims

Whether you’re running a small practice or a large healthcare facility, our team has the tools, tech, and experience to turn your billing department into a revenue machine.

EORs and Compliance

Compliance is another important component of EORs. Is it audit season? EORs are required to support each dollar paid or rejected. Ignored EORs or inadequate documentation may result in audits, fines, or worse. To keep you audit-ready at all times, our staff makes sure each EOR is examined, recorded, and taken into consideration in your billing history.

FAQs

1. What’s the difference between an EOR and an EOB?

An EOR is for providers and explains how much was paid and why. An EOB is for patients and shows what they may owe.

2. How should I respond to a denied claim listed in an EOR?

Start by checking the denial code. Then correct the issue—whether it’s documentation, coding, or timing—and resubmit or appeal.

3. Can I automate EOR analysis?

Yes, using tools integrated with ERA systems, you can automatically flag and track underpayments and denials.

4. Why are some services adjusted or denied even when they seem covered?

Insurers may deny based on lack of medical necessity, incorrect coding, or contract-specific rules. Your EOR explains this.

5. How can DoctorPapers help with EORs?

We analyze every EOR, fight denied claims, optimize your coding, and boost your collections—so you focus on care, not paperwork.

Conclusion

The Explanation of Reimbursement(EOR) is more than just a form; it’s a gateway to financial clarity and revenue recovery. Understanding, interpreting, and acting on your EORs is key to running a healthy, profitable medical practice. With DoctorPapers by your side, you get more than medical billing; you get a strategy to make sure every claim counts.

Stop letting revenue slip through the cracks. Whether you’re drowning in denied claims or just tired of the guessing game in billing, DoctorPapers is your solution.