In the complex world of healthcare, accuracy, speed and compliance in medical claims processing are essential. That’s where a clearinghouse for medical claims steps in, a vital yet often overlooked component in the healthcare reimbursement ecosystem. Whether you’re a solo practitioner or part of a multi specialty group, understanding how the clearinghouse functions can empower your practice to submit cleaner claims and get paid faster.

In this blog, we’ll break down the role of a medical claims clearinghouse, how it supports billing and why it’s a foundational element in revenue cycle management solutions.

What is a Medical Claims Clearinghouse?

A medical claims clearinghouse is a third party organization that acts as a intermediary between healthcare provider and insurance payers (private insurers, Medicare, Medicaid, etc.). The primary role of a clearinghouse is to receive, scrub and electronically transmit medical claims from providers to payers in a standardized and HIPAA compliant format.

Think of the clearinghouse as a post office but for your medical claims. Instead of sending claims directly to hundreds of different payers with varying submission rules, you send all your claims to the clearinghouse, which then ensures each one is properly formatted, validated and routed to the correct insurance carrier.

The Step by Step Process: How a Clearinghouse Works

Let’s take a closer look at the process involved when a clearinghouse handles medical claims.

1. Claim Creations

The first step begin with your internal medical billing services. After a patient visit, the provider documents services rendered, which are then translated into standardized medical codes ICD10, CPT, HCPCS. The medical billing team creates an electronic claim based on these code.

2. Claim Submission to the Clearinghouse

Once the electronic claim is generated, it is submitted to the clearinghouse. This submission is done using EDI (Electronic Data Interchange) format like ANSI X12 837 which is the standard for healthcare claims in the United States.

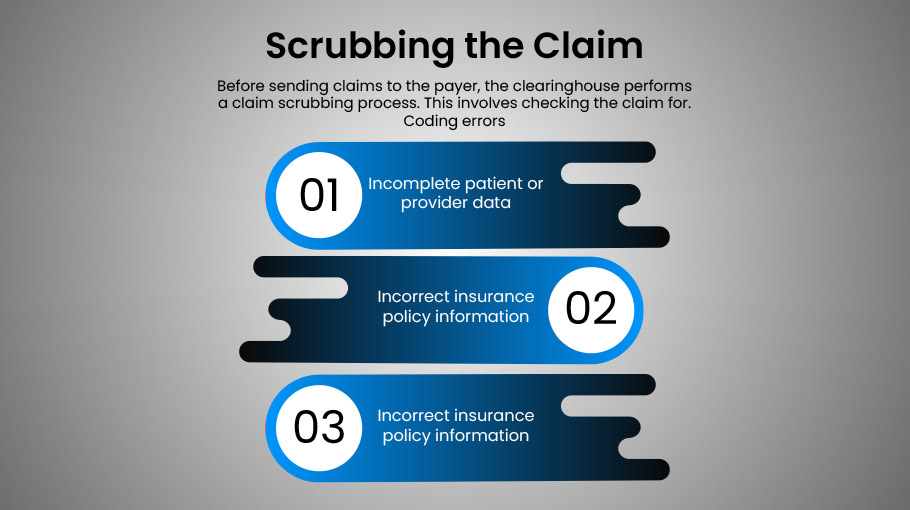

3. Scrubbing the Claim

Before sending claims to the payer, the clearinghouse performs a claim scrubbing process. This involves checking the claim for.

- Coding errors

- Incomplete patient or provider data

- Incorrect insurance policy information

- Compliance with the payer’s claim submission rules

Claims that fail scrubbing are rejected and sent back to the provider for correction, preventing costly denials and delays in reimbursement.

4. Claim Routing

Once scrubbed and validated, the clearinghouse routes the clean claims to the appropriate insurance payer. It does so using direct connections and electronic payer ID to ensure accurate and a very efficient delivery.

5. Acknowledgment and Response

The insurance company sends an acknowledgment of receipt (997/999 report), followed by an Explanation of Benefits (EOB) or Electronic Remittance Advice (ERA) after processing the claim. These documents detail payment decisions or denial reasons.

The clearinghouse returns these responses to your billing system, allowing your staff to quickly act on denials, rejections, or payment.

Why Use a Clearinghouse? Key Benefits

The use of a clearinghouse streamlines a provider’s billing process and enhances overall efficiency in very several ways.

1. Improved Claim Accuracy

By identifying errors before claims reach the payer, clearinghouses significantly reduce the number of denials & rejections.

2. Fast Reimbursements

With clean, correctly formatted claims reaching the payer more quickly, providers enjoy faster turnaround times for payments.

3. Centralized Management

Instead of managing submissions to dozens or hundreds of payers manually, a clearinghouse centralizes your claim submissions, making the process seamless.

4. Better Compliance

Clearinghouses stay updated with the latest insurance payer rules and government regulations. This protects your practice from non compliance penalties and rejected claims.

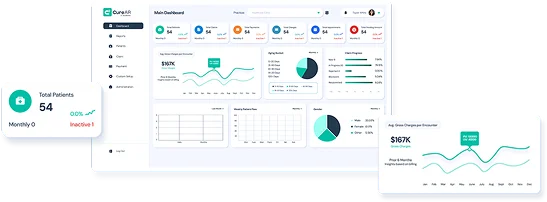

5. Enhanced Reporting

Many clearinghouses offer dashboards and analytics tools that help providers track claim statuses, spot trends and measure billing team performance, key components of strong revenue cycle management solutions.

Clearinghouse vs. Direct Payer Submission

While some large practices or health systems may choose to submit claims directly to payers, this requires a high level of technical infrastructure and payer specific contracts. Most providers, especially small to medium practices, benefit from the efficiency, reliability and cost effectiveness that clearinghouses provide.

The Role of Medical Billing Services and RCM

Partnering with professional medical billing services means you’re likely already benefiting from a clearinghouse solution. Billing experts use clearinghouses as part of a broader revenue cycle management solution, ensuring each phase, from patient check in to final payment is optimized.

A well integrated clearinghouse enhances:

- Eligibility verification

- Claims submission and tracking

- Denial management

- Payment reconciliation

By reducing manual work, cutting down errors and improving cash flow, the clearinghouse becomes an indispensable part of successful medical billing and revenue management.

Final Thoughts

The clearinghouse is more than just a digital courier for your claims, it’s a strategic ally in achieving cleaner submissions, quicker payments and fewer denials. In the fast paced and regulation heavy world of healthcare, understanding and leveraging the clearinghouse process is key to long term financial health.

![Cost of Hiring Virtual Medical Assistants in the USA [2026] Blog Banner](https://doctorpapers.com/wp-content/uploads/2025/12/Cost-of-Hiring-Virtual-Medical-Assistants-in-the-USA-2026-300x152.webp)