Choosing a health insurance plan can feel like learning a new language. Between acronyms like PPO and HMO and fine print details about networks, deductibles, and copays its no surprise most people feel lost before they even begin.

This article goes beyond the surface to help both healthcare professionals and patients understand the real differences between PPO and HMO plans and how they directly impact doctor credentialing, revenue cycles, and practice growth.

Why Insurance Plan Type Matters to Your Practice

Patients are not the only ones impacted by the form of their insurance plan, whether it is an HMO or PPO. It has an impact on the documentation needed, how providers are compensated, and how quickly you get compensation.

Understanding the plan landscape is the first step if your healthcare company or physician group wants to expedite reimbursements, lower claim denials, and enter in-network more quickly.

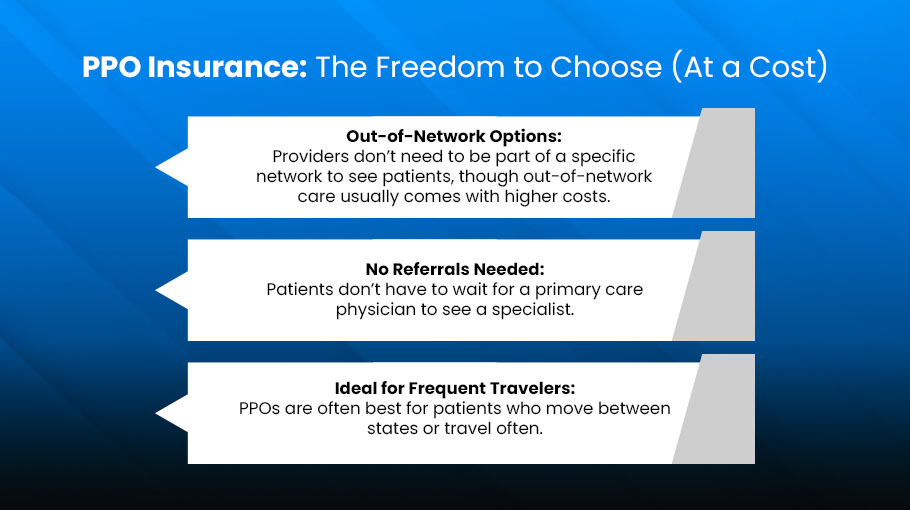

PPO Insurance: The Freedom to Choose (At a Cost)

A Preferred Provider Organization is designed with flexibility in mind. Patients can see any doctor or specialist without a referral and aren’t limited to a small network. Great, right? Yes, but there’s a catch.

What Makes PPOs Appealing

- Out-of-Network Options: Providers don’t need to be part of a specific network to see patients, though out-of-network care usually comes with higher costs.

- No Referrals Needed: Patients don’t have to wait for a primary care physician to see a specialist.

- Ideal for Frequent Travelers: PPOs are often best for patients who move between states or travel often.

The Hidden Side for Providers

If you’re not credentialed with the patient’s PPO insurance, you’re considered out-of-network. That means:

- You’ll need to bill the patient directly or fight for partial reimbursement.

- Patients may choose a credentialed competitor over you to save money.

Doctor credentialing services become essential here. Without proper enrollment in PPO networks, you risk losing patients who prefer convenience and affordability.

HMO Insurance: Structure, Simplicity, and Cost Control

An HMO (Health Maintenance Organization) offers a more budget-friendly option but it comes with strings attached.

HMO Pros for Patients

- Lower Premiums and Copays: Great for people on a tight budget.

- Coordinated Care: All care is funneled through a primary care physician (PCP), who acts as a gatekeeper for specialists.

- Predictable Billing: Less surprise billing since out-of-network visits (except in emergencies) usually aren’t covered.

The Catch for Providers

To serve HMO patients, you must be credentialed and contracted with the HMO network. If you’re not in-network, the patient can’t see you, and insurance won’t pay. That’s why credentialing services are not optional they are critical. Being properly enrolled with HMO carriers means:

- You get access to a steady stream of insured patients.

- Your reimbursements are faster and more consistent.

- You reduce claim denials due to out-of-network status.

Credentialing: The Gatekeeper to Growth

It doesn’t matter how experienced or skilled a physician is if they’re not credentialed, they don’t get paid. Credentialing ensures that providers meet all standards set by the insurance company and regulatory boards. And it’s the foundation of being listed as in-network. Here’s why medical billing and credentialing services are a strategic asset to any practice:

- Accelerate Revenue: Credentialing helps you start billing patients from day one.

- Build Trust: Being in-network boosts patient confidence and referrals.

- Prevent Revenue Gaps: No more seeing patients you can’t bill for.

- Simplify Enrollment: Credentialing experts handle the back-and-forth paperwork, follow-ups, and compliance.

Whether you’re working with PPOs or HMOs, the road to clean claims and steady income begins with proper credentialing.

Billing Implications: PPO vs. HMO

Billing and reimbursement workflows vary significantly between the two plan types.

PPO Billing Complexity

- Out-of-network claims often require more documentation.

- Higher chances of denials and partial payments.

- Patients may need to pay upfront, creating more billing inquiries for your staff.

HMO Billing Simplicity

- Streamlined processes if you’re in-network.

- Less paperwork, fewer denials, and more predictable reimbursements.

- But if you’re not credentialed? You’re out.

With solid billing and credentialing services, these challenges become manageable, helping practices avoid backlogs and maintain cash flow.

How DoctorPapers Can Help You Navigate Both Worlds

At DoctorPapers, we don’t just understand PPOs and HMOs, we help you thrive in both. Our team specializes in:

- Doctor credentialing services that get you in-network fast.

- Medical credentialing services that are seamless, compliant, and reliable.

- Handling insurance-specific requirements, so you can focus on patient care, not paperwork.

- Resolving claim denials tied to credentialing issues.

Whether you’re launching a new practice or expanding into new networks, we help you move faster and smarter.

Let’s Be Honest—Most Practices Struggle With This

Credentialing isn’t exciting. Billing isn’t glamorous. But these are the silent engines that fuel your growth. Without expert support, you end up:

- Losing patients who prefer in-network care.

- Facing delays in reimbursement.

- Getting stuck in a never-ending paperwork maze.

With DoctorPapers, you don’t have to deal with all that alone. You get a partner who knows how to play the insurance game and win.

Final Thoughts: PPO vs. HMO Is More Than a Patient Decision

Yes, the difference between PPO and HMO affects patients, but it also determines how your medical practice operates, earns, and scales. If you’re not actively credentialing your providers or keeping up with payer rules, you’re leaving money on the table.

![Cost of Hiring Virtual Medical Assistants in the USA [2026] Blog Banner](https://doctorpapers.com/wp-content/uploads/2025/12/Cost-of-Hiring-Virtual-Medical-Assistants-in-the-USA-2026-300x152.webp)