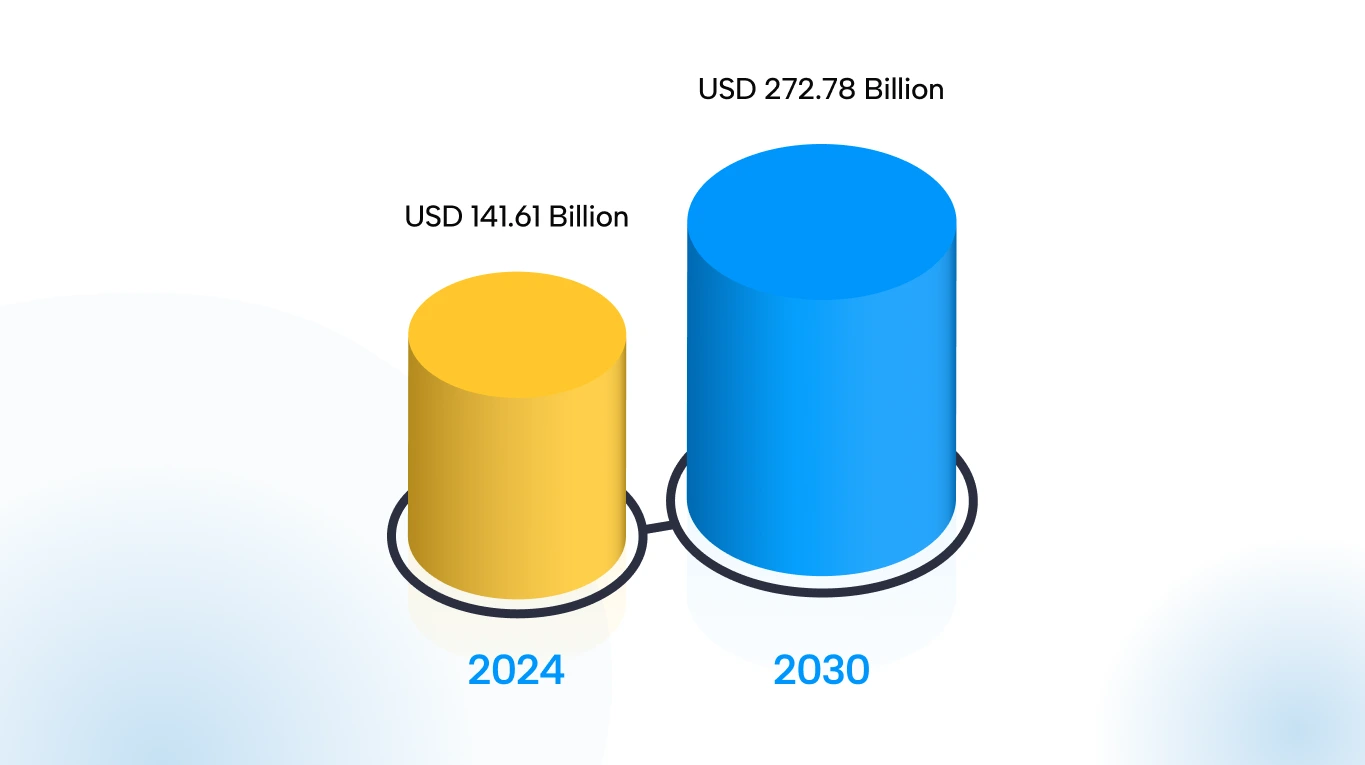

Understanding revenue cycle management (RCM) in healthcare has become crucial for medical practices in 2025. This is due to the complexities of the modern medical billing process, which are affecting revenue collections and the overall financial performance of healthcare providers. At the same time, the U.S. medical billing market continues to expand rapidly, with RCM projected to grow at a 11.6% CAGR from 2024 to 2030.

With shrinking margins and a shift toward value-based care, healthcare leaders are prioritizing cash flow and process efficiency. A solid understanding of RCM can help practices identify gaps, streamline workflows, and make informed financial decisions that drive better performance.

What Is Revenue Cycle Management (RCM) in Healthcare?

RCM refers to the end-to-end financial process of capturing, managing, and collecting patient service revenue. It covers every step, from patient scheduling and insurance verification to coding, billing, claims submission, and payment collection. Essentially, it connects the clinical and financial sides of healthcare, ensuring providers are properly reimbursed for their services.

The Key Components of the Healthcare Revenue Cycle

RCM ties together multiple functions in a medical provider’s financial operations. The nine key components are as follows:

- Patient Scheduling and Preregistration:

Collecting patient demographics and insurance details before the visit.

- Patient Registration and Check-In

Confirming patient identity, insurance, and collecting co-pays at the point of service.

- Insurance Eligibility Verification

Ensuring coverage and obtaining pre-authorization for services when needed.

- Charge Capture and Coding

Documenting clinical services and assigning appropriate ICD/CPT codes for billing.

- Claim Creation and Submission

Preparing and electronically submitting claims to payers for reimbursement.

- Payment Posting and Reconciliation

Recording payments from insurers and patients, and balancing accounts.

- Denial Management and Appeals

Tracking rejected or denied claims, correcting errors, and resubmitting appeals.

- Patient Billing and Collections

Generating patient invoices for remaining balances and managing payment plans.

- Reporting and Analytics

Monitoring financial KPIs, compliance checks, and preparing audit reports.

Each of the above stages is interrelated, meaning a breakdown at any point can delay revenue. For example, errors in registration or coding can lead to denials downstream. Effective RCM simplifies these components to ensure accuracy and efficiency.

How RCM Works: Step-by-Step Process

A revenue cycle follows distinct phases. According to industry guidelines, a typical RCM workflow includes the following steps:

1: Pre-registration and Scheduling

The patient schedules an appointment. Administrative staff collect basic demographics and insurance information and verify eligibility. Pre-authorization requirements for procedures or medications are obtained at this stage.

2: Patient Registration and Check-In

Upon arrival, the patient’s information is verified. Front-desk staff confirm personal and insurance details, secure signatures on financial forms, and collect any required copays or deposits.

3: Charge Capture and Medical Coding

Clinicians document all services provided during the encounter. Medical coders then translate diagnoses and procedures into standardized codes, which determine billing and reimbursement rates.

4: Claim Creation and Submission

The billing office generates insurance claims using the coded data. Claims are electronically scrubbed for errors and then submitted to payers. The payer evaluates each claim and decides whether to pay, deny, or reject it.

5: Denial Management and Follow-Up

If a claim is denied or requires correction, the RCM team investigates the reason and submits appeals or corrected claims. Effective denial management is crucial to recover potential revenue.

6: Payment Posting (Remittance Processing)

Once claims are approved, the insurer’s payments and explanation of benefits (EOB) are posted to the patient’s account. The practice reconciles the paid amount and any differences.

7: Patient Billing and Collections

Any remaining balance, such as co-insurance, deductibles, and non-covered services, is billed to the patient. The RCM team follows up on unpaid patient bills via statements, payment plans, or collection agencies.

8: Reporting and Data Analytics

Throughout the cycle, data is collected and reported. Systems that include dashboards and analytics tools help track key performance indicators and forecast cash flow.

Importance of RCM in Healthcare Organizations

Efficient RCM is vital for a provider’s financial health. Key benefits of strong RCM include:

- Maximized revenue collection: Minimizing denials and capturing all billable services ensures providers collect their full due.

- Improved cash flow: Faster claim submission and payment posting shorten the cash conversion cycle, increasing liquidity.

- Reduced days in A/R: Prompt billing and follow-up reduce the average age of accounts receivable, lowering the risk of write-offs.

- Lower administrative costs: Automation and simplified workflows reduce manual labor and errors, cutting operational expenses.

- Regulatory compliance: Adhering to billing and coding rules (e.g., HIPAA, Medicare regulations) reduces audit risk and potential penalties.

- Better patient satisfaction: Clear billing and communication improve the patient financial experience, as rising patient responsibility makes transparency critical.

- Data-driven decisions: Tracking KPIs (like net collection rate) provides insight into bottlenecks, enabling continuous improvement.

Common Challenges in Revenue Cycle Management

Despite its importance, RCM faces many hurdles. Common challenges are discussed below:

- High Claim Denial Rates

Payers deny or reject a substantial share of claims. A survey found 41% of provider leaders experience denial rates above 10%, requiring extra resources for appeals.

- Complex Regulations and Coding Rules

Constant changes in billing codes (ICD, CPT), value-based rules, and payer policies increase the risk of errors and audits.

- Staffing Shortages

Many providers struggle to find and retain skilled coders and billing specialists. One report projects a demand of over 1 million registered nurses by 2026, intensifying resource constraints.

- Data Integration Issues

Fragmented systems, such as separate EHR and billing platforms, can lead to duplicate data entry and delays. Lack of interoperability hinders the flow of real-time information.

- Patient Payment Collection

With more high-deductible health plans, patients owe more out of pocket. Collecting patient payments can be difficult and may result in bad debt.

- Cybersecurity and Data Breaches

Nearly half (47%) of healthcare leaders indicate that they feel ill-equipped to handle cyber threats, underscoring a significant gap in preparedness. Data breaches can incur costs and disrupt billing.

- Regulatory Penalties

Mistakes in RCM, such as upcoding and duplicate billing, risk fines under fraud-and-abuse laws. Ensuring legal compliance is an ongoing challenge.

- Operational Disruptions

System downtime, pandemics and payer payment delays also strain the revenue cycle.

Role of Technology and Automation in RCM

Technology is reshaping RCM efficiency and accuracy. Key innovations include:

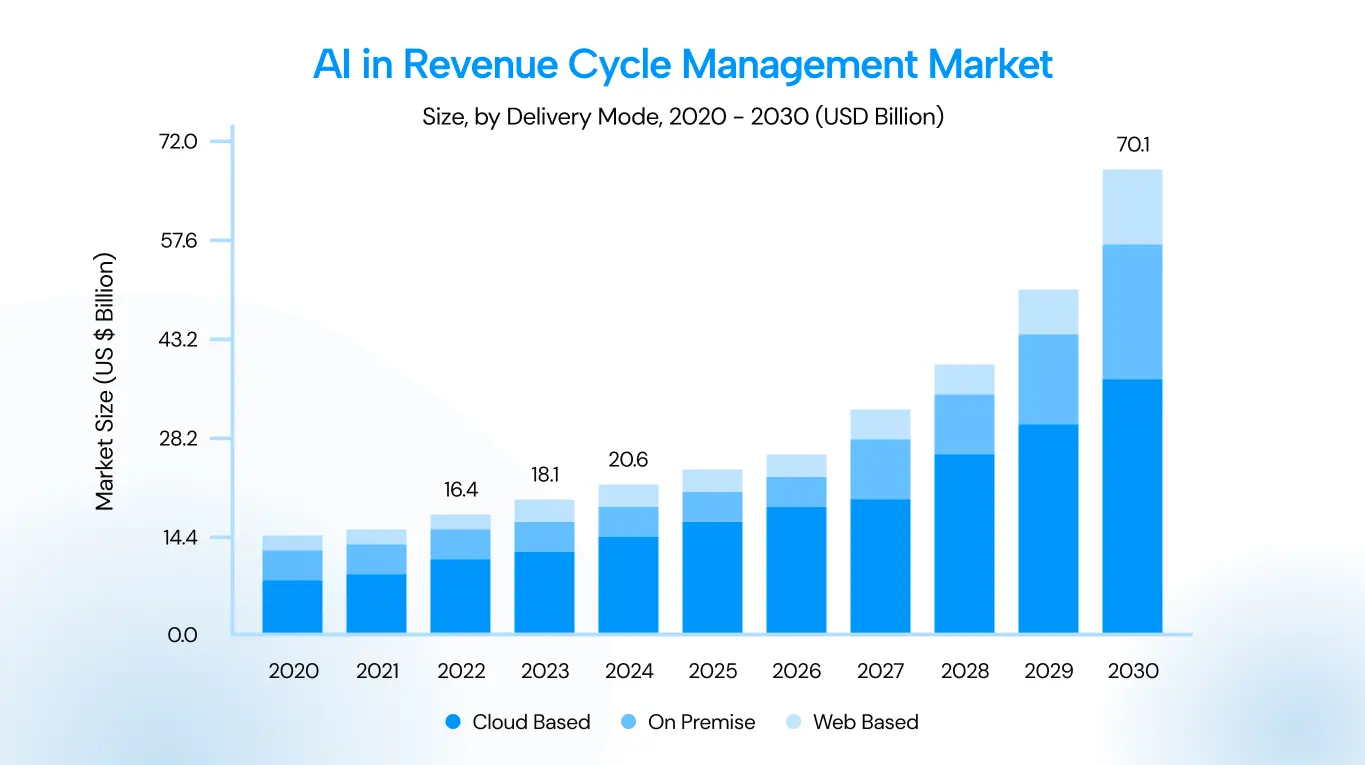

Artificial Intelligence (AI) & Cloud-Based RCM

The global market for AI in RCM was valued at approximately USD 20.63 billion in 2024 and is anticipated to grow to USD 70.12 billion by 2030, with a CAGR of 24.16% from 2025 to 2030. Key factors driving this expansion include increased healthcare claim denials, the complexity of payer regulations, and a shift from transactional to value-based RCM.

Moreover, AI solutions that integrate smoothly with RCM platforms, electronic health records (EHRs), and payer systems are becoming more popular. Interoperability is vital for enabling real-time claims processing and maintaining payment integrity.

Vendors are also increasingly offering APIs and cloud-based solutions that enhance data exchange between clinical and financial systems. This is supported by the growing share of cloud-based delivery in RCM from 2020 to 2030, as depicted below.

Moving RCM to the cloud offers scalability, remote access, and faster updates of code sets and regulations. It also enhances disaster recovery and security management.

Automated Workflows & Analytics

Tasks such as eligibility checks and prior authorizations can run in real time, freeing staff to focus on more complex cases. Robotic process automation (RPA) handles repetitive tasks, such as claim scrubbing and payment posting, improving throughput.

Moreover, advanced analytics platforms enable real-time KPI tracking and predictive forecasting. Dashboards highlight denial trends, aged A/R, and identify revenue leakage points in the RCM process. Also, online portals allow patients to view bills, make payments, and communicate with billing staff, improving collections and patient satisfaction.

Emerging Technologies

Generative AI (GenAI) and large language models (LLMs) are poised to further automate documentation and coding. They improve invoice accuracy and compliance by automating multifaceted validation during invoice processing. They can flag anomalies, check tax and regulatory rules, and produce clear discrepancy reports with recommended fixes.

Moreover, early error detection reduces fraud risk and frees staff from manual checks, thereby improving operational efficiency and the employee experience. GenAI makes customer-facing documents flexible and personal by generating multi-format, multi-language invoices from a library of templates and business rules.

Furthermore, GenAI can roll up charges by account hierarchy, geography, or billing entity and automatically produce customer-preferred layouts, reducing the overhead of bespoke requests.

This ensures faster payments, fewer disputes, higher retention, and less manual effort for billing teams.

Beyond invoicing, GenAI helps close revenue leakage across quoting, contracting, order management, and renewals by detecting non-standard terms, mapping performance obligations, and correcting upstream data issues.

Combined with ML-driven forecasting and real-time driver analytics, GenAI enables more accurate revenue recognition, uncovers missed upsell and cross-sell opportunities, and delivers on-demand insights via conversational interfaces.

Revenue Cycle Management and Compliance

Compliance is an integral part of every stage of the revenue cycle. Key requirements include:

- HIPAA Privacy and Security: Protecting patient health information (PHI) throughout billing, ensuring secure data handling and breach prevention.

- Coding and Billing Regulations: Following accurate coding guidelines and payer-specific rules to avoid fraud or misbilling. Many RCM systems include built-in compliance checks.

- Medicare/Medicaid Rules: Adhering to Centers for Medicare & Medicaid Services (CMS) guidelines, including National Correct Coding Initiative (NCCI) edits, reimbursement policies, and mandatory reporting, is essential for proper reimbursement.

Anti-fraud and abuse laws: The Stark Law and Anti-Kickback Statute require that billing be free of improper referrals or kickbacks. RCM compliance programs audit claims for these issues.

Price transparency and patient billing laws: Recent rules (e.g., the No Surprises Act and Good Faith Estimates) affect how providers bill patients and insurers, requiring cost disclosure and limiting surprise bills.

Accurate documentation: Clinical notes must support billed services. Proper documentation practices reduce the risk of audits and denials.

Audit readiness: Effective RCM includes tracking documentation and maintaining an audit trail for all claims. Automated reporting features help prepare for payer or regulatory audits.

RCM Performance Metrics and KPIs

Healthcare organizations track specific metrics to evaluate RCM performance. Key KPIs are depicted in the figure below, followed by the definitions of important metrics:

- Net Collection Rate: Percentage of total possible payments actually collected.

- Days in Accounts Receivable (A/R): Average number of days it takes to collect payment after a service. A lower number means faster cash flow.

- Clean Claim Rate: Percentage of claims paid on first submission without corrections. High clean rates reduce rework.

- Denial Rate: Share of claims denied or rejected.

- Point-of-Service Collection Rate: Percentage of patient balances collected at the time of service.

- Aging A/R Buckets: Distribution of outstanding claims by days unpaid. This highlights how much revenue is tied up beyond normal cycles.

- Cost to Collect: Total RCM operating costs divided by total collections.

- Other metrics include Discharged Not Final Billed (DNFB) rates, the percentage of claims processed electronically, and patient satisfaction with billing.

The Role of Medical Billing Software in RCM

Medical billing software is central to modern RCM. These systems usually integrate or interface with EHR and practice management tools. Here are some of the pivotal features of billing software:

Feature | Description |

Integrated billing & coding modules | Automates charge capture, applies correct ICD/CPT codes, and assembles claims for submission. |

Clearinghouse connectivity | Submits claims electronically to payers and receives ERAs for automated payment posting. |

Claim scrubbing tools | Runs built-in edits to detect errors and compliance issues before claims are sent, reducing rejections. |

Revenue integrity features | Audits claims for correct modifiers, duplicate billing, and other compliance checks before submission. |

Patient statements & portal integration | Generates detailed patient bills, enables online payments, and supports portals for inquiries and payment plans. |

Analytics dashboards | Provides real-time financial reporting and KPI visualizations for managers to monitor revenue health. |

Scheduling & eligibility modules | Verifies insurance eligibility and benefits at the time of booking, reducing denials and coverage surprises. |

Many U.S. practices use EHR systems, and large hospitals typically deploy RCM suites that include billing modules. These platforms aim to simplify the revenue cycle by connecting clinical workflows with finance. For instance, integrated EHR-RCM solutions allow providers to charge for services as they document care, reducing manual handoff errors.

How to Choose the Right RCM Partner

For many organizations, partnering with an RCM vendor or consultant can fill gaps in expertise or technology. When selecting an RCM partner, the Vendor Scorecard can be an effective tool for practices.

The Vendor Scorecard (also known as the Comparison Matrix) is designed to help healthcare leaders make data-driven decisions when selecting the right RCM partner. It evaluates multiple vendors across nine key criteria, allowing decision-makers to assess both qualitative and quantitative performance factors.

Each criterion is scored on a 0–5 scale and assigned a specific weight based on organizational priorities. For example, a hospital might place a heavier weight on compliance and technology, while a small clinic may prioritize pricing and customer support. The matrix then calculates a weighted total score for each vendor, enabling administrators to quickly identify which partners best match their operational and strategic goals.

Beyond simple scoring, the scorecard promotes transparency and accountability in the selection process. Each cell in the table below not only shows a numerical score but also provides supporting evidence, such as certifications, client references, or technology capabilities.

Moreover, the “Target/Ideal” column serves as a benchmark, defining the organization’s minimum acceptable standard for each category. Comparing RCM vendors side-by-side against this benchmark enables decision-makers to pinpoint strengths, gaps, and trade-offs at a glance.

Ultimately, the scorecard turns what can often be a subjective, intuition-driven process into an objective, measurable framework. This ensures that the chosen RCM vendor is not only a strong technical fit but also strategically matches a practice’s long-term financial and patient care goals.

Here’s a hypothetical example of the Vendor Scorecard method in action:

Criteria | RCM Vendor A | RCM Vendor B | RCM Vendor C | Target |

Domain expertise | 4/5 — 10 yrs ambulatory | 3/5 — 5 yrs community hospitals | 5/5 — 20 yrs hospital systems | 4/5 — Specialty experience |

Technology & platform | 5/5 — Cloud-native, API-first | 3/5 — On-prem + cloud | 4/5 — Cloud + analytics | 4/5 — Cloud, APIs |

Compliance & security | 5/5 — HITRUST, SOC2 | 4/5 — HIPAA, SOC2 pending | 3/5 — HIPAA only | 4/5 — HITRUST/SOC2 |

Pricing model | 3/5 — 5% collections | 4/5 — per-claim fixed | 2/5 — high setup + monthly | 3/5 — transparent fees |

Scalability & flexibility | 4/5 — auto-scale, APIs | 3/5 — limited multi-site | 5/5 — proven enterprise scale | 4/5 — multi-site support |

Customer support | 4/5 — 24/7 AMs | 2/5 — limited hours | 5/5 — dedicated AM + SLAs | 4/5 — 24/7 support |

Performance guarantees | 4/5 — collection SLAs | 3/5 — best-effort | 4/5 — yield improvement guarantees | 3/5 — measurable SLAs |

Reputation & references | 4/5 — 15 refs, case studies | 3/5 — 6 refs | 5/5 — large system references | 4/5 — proven track record |

Strategic alignment | 3/5 — growth-focused | 4/5 — conservative approach | 5/5 — aligned to VBC | 4/5 — supports VBC |

The Vendor Scorecard method to find the ideal RCM partner

The total weighted scores for the three RCM vendors are as follows:

Vendor A: 4.21

Vendor B: 3.21

Vendor C: 4.13

The results above show that RCM Vendor A has the highest weighted score and is therefore the best-fit RCM vendor for the hypothetical case.

The Future of Revenue Cycle Management in Healthcare

The year 2026 will be a turning point for RCM in healthcare. Providers are already confronting workforce shortages, mounting financial pressures, and ever more complex payer requirements, so modernization is no longer optional.

Entering 2026, operational stresses are expected to intensify across healthcare practices. Organizations may face talent bottlenecks in specialized billing roles, fragmented systems that hinder data-driven decision-making, and financial strain from stagnant reimbursement and rising denials. Those pressures will make automation, interoperability, and smarter workflows essential to protect cash flow.

Automated Bots

An interesting feature expected to become more prevalent in healthcare RCM is automated bots, which can scrub claims, verify eligibility, and surface appeal opportunities. These chatbots handle routine patient billing questions and personalize payment plans.

The expected result of employing automated bots in RCM workflows is lower manual effort, fewer errors, and a shift in staff roles toward exception handling and oversight.

Value-Based Payment Models

Value-based payment models are expected to continue to expand and complicate revenue recognition. With projections that value-based arrangements could account for a large share of provider revenue by 2026, practices must track longitudinal performance, integrate social-determinant and clinical data, and tighten documentation and risk-adjustment processes.

Moreover, unified RCM platforms that support multiple payment models and deliver contract-level insights will be strategic assets in 2026.

Greater RCM Outsourcing

Outsourcing RCM will accelerate as providers seek scale and expertise. With outsourced RCM demand growing and market forecasts showing strong CAGR, many hospitals and physician groups will turn to vendors for accuracy, technology, and elasticity. Careful vendor selection will become a critical decision for practices in 2026.

Comprehensive Integrations and AI-Enabled Forecasting

End-to-end integration will become critical for practices. Fragmented, siloed systems will no longer suffice, and integrated RCM platforms that unify scheduling, coding, and billing and reduce payment data errors will be more effective. Cross-continuum analytics for bundled and population-based payments will be in demand.

Moreover, advanced analytics and predictive models enable proactive financial management. AI-driven forecasting can project cash flow and identify denial drivers far earlier, while payer-behavior analysis helps optimize negotiations and reimbursement. Practices using these tools will report measurable revenue recovery and significant reductions in denial rates.

Patient-Focused and Compliant Billing

Patient-centered billing is expected to become a competitive differentiator. Transparent estimates, flexible payment plans, and digital-first statements will improve the patient experience and lift collections. As patient financial responsibility grows, billing must become clearer, faster, and more consumer-friendly to protect retention and revenue.

Moreover, security and compliance will remain non-negotiable. The expansion of digital tools will increase exposure to cyber threats and regulatory scrutiny. Organizations must invest in continuous threat detection, powerful controls, and compliance programs.

That’s a Wrap!

RCM is the financial backbone of healthcare delivery. Its complexity reflects the fragmented nature of U.S. healthcare payments, but it also presents opportunities for improvement. Understanding each component of the RCM process and rigorously monitoring performance metrics can enable providers to plug revenue leaks and enhance financial stability.

As RCM technologies continue to advance, practices can shift their focus from manual claim chasing to strategic financial planning. Effective RCM not only preserves margins but also supports better patient care by reducing administrative burdens.

Ultimately, investing in optimized revenue cycle processes and partnerships is essential for healthcare organizations to thrive amid rising costs and evolving payment models.

![Cost of Hiring Virtual Medical Assistants in the USA [2026] Blog Banner](https://doctorpapers.com/wp-content/uploads/2025/12/Cost-of-Hiring-Virtual-Medical-Assistants-in-the-USA-2026-300x152.webp)