Payment posting might sound like a simple back-office task, but it’s one of the most important steps in the medical billing process. It refers to recording and reconciling payments received from insurance companies and patients against the billed claims. When done correctly, it gives healthcare providers a clear picture of what’s been paid, what’s still pending, and where discrepancies exist.

This blog will break down what cash posting in medical billing really means, why it’s vital for financial accuracy, and how it impacts the overall revenue cycle.

Types of Payment Posting

Posting your payments in medical billing occurs in one of two ways, depending on the patient’s financial situation and the extent of their insurance coverage:

Manual Posting

To complete manual postings, the administrative staff must fill out additional information, which typically takes more time. Among the many problems that cause posting costs to be delayed are typos, which are more likely to occur during this process.

Auto Posting

The majority of businesses opt for auto-payments as their technology solution, a software-driven approach that streamlines the medical billing process for consistent cash flow. However, few independent physicians believe that manual revenue posting compromises their ability to oversee their revenue-generating systems.

Step-by-Step Process

Payment allocation ensures that all received payments, whether via checks, cards, transfers, or cash, are accurately logged, identified, and applied to the correct accounts. Through reconciliation, discrepancies are promptly resolved, ensuring that financial records are accurate, compliant, and supportive of a strong cash flow.

Getting Paid

Cash, credit/debit cards, cheques, and electronic transfers are just a few of the ways that payments can be made. Payments must be entered into the company’s accounting system as soon as they are received.

Recognizing Payments

Payments must be linked to the appropriate account or client as soon as they are received. To ensure the payment is applied to the correct account, it may be necessary to compare invoices or account numbers.

Making Payments

A payment must be applied to any outstanding balances when it has been located and linked to the appropriate account. This could entail assigning the money to particular account balances or invoices.

Reconciliation and Record Updates

When posting your medical bills, reconciliation is the process of verifying that payments made by insurance companies or patients match the associated costs. With up to 80% of medical bills containing errors in the U.S, this step is critical to financial accuracy. This involves comparing payment amounts, dates, and other details against claims, invoices, or receipts to spot inconsistencies. When discrepancies are found, the posting team must promptly investigate and resolve them to avoid future billing and financial issues.

Since accurate and current financial records are vital for controlling cash flow, adhering to regulatory standards, and preserving the healthcare provider’s financial stability, reconciliation is a necessary component of posting your bills.

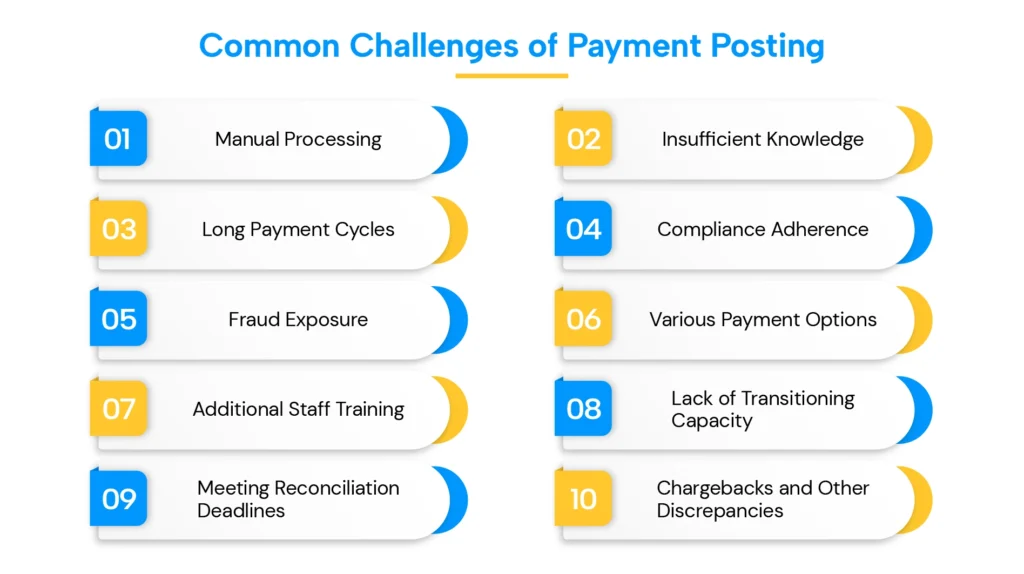

Common Challenges

Medical billings in healthcare organizations may be affected by several issues related to the accurate posting of payments. We’ll examine ten key issues with healthcare payments, including the detrimental dependence on manual processing, the lack of information regarding payment patterns, and several other concerns.

Manual Processing

Healthcare organizations face inefficiencies due to manual processes like paper checks, which lead to administrative strain and delays. The reliance on paper-based payments detracts from patient care and contributes to significant waste, with the U.S. healthcare system responsible for over 25% of global paper waste. Emphasizing quality care is essential, as manual processing raises the risk of late or missed payments.

Insufficient Knowledge

Effective analytics and well-informed financial decision-making are hindered by the current medical billing payment posting services, which lack sufficient insight into the expenditure and payment patterns of healthcare organizations. Due to manual processes, this deficiency affects accounts receivable management, resulting in increased human error and a substantial loss of reliable data, as well as further operational inefficiencies.

Long Payment Cycles

In the healthcare industry, where paper-based billing remains the norm, electronic payments are rarely utilized. Increased operating expenses and longer billing cycles may result from this reliance on paper. Furthermore, it causes mistakes that harm patient relationships and the entire healthcare experience by leading to missed discounts and unpaid payments.

Compliance Adherence

Healthcare companies must ensure medical billing compliance with industry standards to protect sensitive information on medical claims and payments, as noncompliance may result in fines and damage patient trust. Current revenue posting methods may compromise patient privacy (PHI), which is necessary for effective care management. Manual payment processing often undermines security, whereas automated software can help meet compliance standards in invoicing effectively.

Fraud Exposure

If you don’t have secure billing procedures in place, your medical billing operations are vulnerable to fraud. Financial malpractices may result from unauthorized workers taking advantage of manual billing. Strong technologies, such as data encryption and secure payment systems, are crucial in mitigating the risk of fraud and protecting patient financial information while maintaining confidence.

Various Payment Options

To meet reimbursement claims, the healthcare industry offers various payment options, which can complicate billing arrangements due to the diverse financial relationships it maintains with patients and insurers. Effective communication of these arrangements to patients is crucial for ensuring that payments align with patient-focused processes and financial flows.

Additional Staff Training

Healthcare businesses must make the challenging transition to a modern payment system, which may involve investing in a technical invoice-to-pay solution, as well as allocating additional resources for staff training. This entails integrating patient payment options with the medical billing system and ensuring that staff members are properly trained to accurately and efficiently automate the posting of payments. Furthermore, it is crucial to instruct patients on how to use the new medical bill payment workflow.

Lack of Transitioning Capacity

The current infrastructure of most healthcare organizations is inadequate for transitioning to electronic billing applications. Although payment trends in the industry may prompt a shift, financial constraints hinder the establishment of necessary systems. To enhance cash posting automation and improve patient payment experiences, providers must consider allocating more funds for onboarding key vendor services that can effectively facilitate this transition.

Meeting Reconciliation Deadlines

Meeting reconciliation deadlines is necessary for efficient medical billing; however, this can be challenging due to manual processing and coordination issues within departments. High transaction volumes may cause practices to falter, which would impact timely reconciliations. Furthermore, to produce accurate invoices, posting your payments requires careful assessment, highlighting the necessity of regulated cash posting to ensure coordinated financial reporting.

Chargebacks and Other Discrepancies

Chargebacks are a significant issue for healthcare organizations, often linked to financial fraud, and can harm financial stability. They require careful handling to avoid disrupting communication with patients, as frequent chargebacks may lead to a loss of trust from patients.

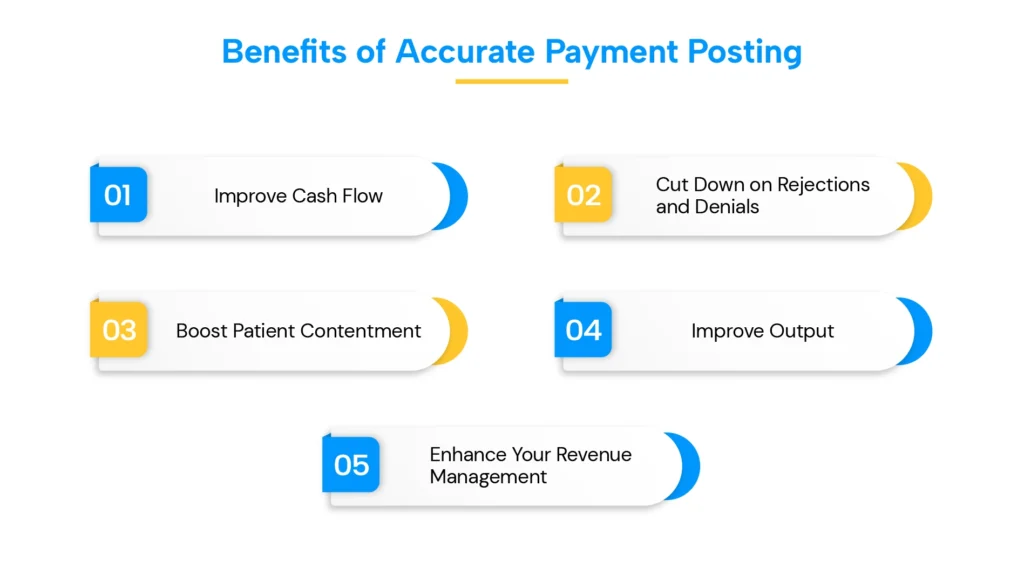

Benefits of Accurate Payment Posting

Correct accounts receivable management and accurate payment recording are guaranteed by accurate revenue posting. This aids medical professionals:

Improve Cash Flow

Healthcare providers are guaranteed to receive accurate and on-time service payments when payments are posted accurately and in a timely manner. As there is a lower chance of late payments, denied claims, or inaccurate payment amounts, this ultimately leads to better cash flow. Healthcare providers can use accurate bill posting to identify issues and take action to reduce the likelihood of revenue leakage.

Cut Down on Rejections and Denials

Rejections and denials of claims are less likely when payments are posted accurately and in a timely manner. Healthcare providers can prevent mistakes and omissions that result in claim rejections by ensuring that payments are submitted accurately and in a timely manner. This shortens the time it takes to get paid and saves time and effort rewriting denied claims.

Boost Patient Contentment

Patient satisfaction increases when payments are posted accurately and promptly. When patients receive accurate bills and timely, clear payment information, they are more likely to be happy. This enhances patient loyalty and contributes to favorable evaluations and recommendations.

Improve Output

Productivity rises when payments are posted accurately. By reducing the likelihood of rejections and denials, healthcare providers can save time and money spent on redoing claims, as they can now focus on providing high-quality care instead of managing payment-related concerns. This, in turn, leads to increased productivity.

Enhance Your Revenue Management

Healthcare practices can better monitor their financial performance and prevent revenue loss due to payment issues or delays by accurately reporting payments. This ensures accurate and effective patient billing, while also enhancing cash flow and financial stability.

Role of Payment Posting in Revenue Cycle Management

To precisely track income and maintain financial stability, bill posting is a critical step in revenue cycle management services. To increase cash flow, reduce errors, and enhance overall financial performance, its functions include accurately logging payments, reconciling accounts, identifying payer difficulties such as refusal patterns, and providing data for analysis and decision-making.

From claim adjudication to posting, these key steps define how payers process claims, communicate decisions, and update your accounts.

- Claim adjudication: The payer reviews and processes a claim after it is filed.

- Electronic Remittance Advice (ERA) or Explanation of Benefits (EOB): The payer provides an ERA or EOB outlining the payment status, including any changes, denials, or payments.

- Revenue Posting: This process updates patient and payer accounts by entering data from the EOB/ERA into the provider’s practice management software.

Conclusion

Effective medical billing depends on accurate bill posting. Healthcare providers can ensure that payments are accurately recorded and processed with DoctorPapers. Accounts receivable are effectively managed by understanding the posting procedure, utilizing the right tools and best practices, and regularly auditing payment posting activities. This can help to increase cash flow, reduce accounts receivable, improve RCM, and eliminate claim denials and rejections.

Frequently Asked Questions

- What does transaction posting mean in medical billing?

It is the process of recording payments from patients and insurance companies into a healthcare provider’s billing system. It ensures all payments are accurately applied to the correct accounts, helping maintain transparency and financial accuracy.

- Why is accurate payment allocation important for healthcare providers?

Accurate payment reconciliation is crucial for tracking revenue, managing accounts receivable, and identifying denied or underpaid claims. It directly impacts cash flow, financial stability, and the overall efficiency of a provider’s revenue cycle.

- What is the difference between manual and auto revenue posting?

Manual payment reconciliation involves staff manually entering payment details, which can be time-consuming and prone to errors. Automated revenue posting utilizes medical billing software to streamline data entry, enhancing cash flow and reducing human error.

- What are the common challenges in cash posting?

Common challenges include manual processing delays, lack of payment pattern insights, long reconciliation cycles, and compliance risks. Automation and real-time analytics can help resolve these issues and improve billing accuracy.

- How does posting bill payments fit into revenue cycle management (RCM)?

Revenue posting is a crucial step in RCM, as it updates financial records after claim adjudication and remittance. By ensuring accurate posting, providers can reduce denials, enhance reporting, and make more informed financial decisions.

![Cost of Hiring Virtual Medical Assistants in the USA [2026] Blog Banner](https://doctorpapers.com/wp-content/uploads/2025/12/Cost-of-Hiring-Virtual-Medical-Assistants-in-the-USA-2026-300x152.webp)